Free printable bill tracker is a powerful tool for effective personal financial management. Discover how this simple yet essential resource can help you stay on top of your bills and take control of your finances.

In this comprehensive guide, we will explore the benefits of using a printable bill tracker, provide tips on finding the right one, discuss its features and design options, and offer practical advice on how to use and customize it. Whether you’re a budgeting beginner or a seasoned financial planner, this guide will equip you with the knowledge and tools to stay organized and financially stable.

Introduction to Free Printable Bill Tracker

A bill tracker is a tool used to keep track of various bills and payments. It helps individuals manage their personal finances by providing a clear overview of their financial obligations and ensuring that payments are made on time.Using a printable bill tracker offers several benefits.

Firstly, it provides a tangible and visual representation of one’s financial responsibilities. By having a physical copy, individuals can easily refer to it and update it as needed. This eliminates the risk of forgetting or missing any payments.Secondly, a printable bill tracker allows for customization and organization.

Different types of bill trackers can be found online and printed for free. These trackers can be tailored to suit individual needs and preferences. Whether it’s a monthly tracker, a weekly tracker, or a specific tracker for certain bills, there are plenty of options available.Here

are some examples of different types of bill trackers that can be printed for free:

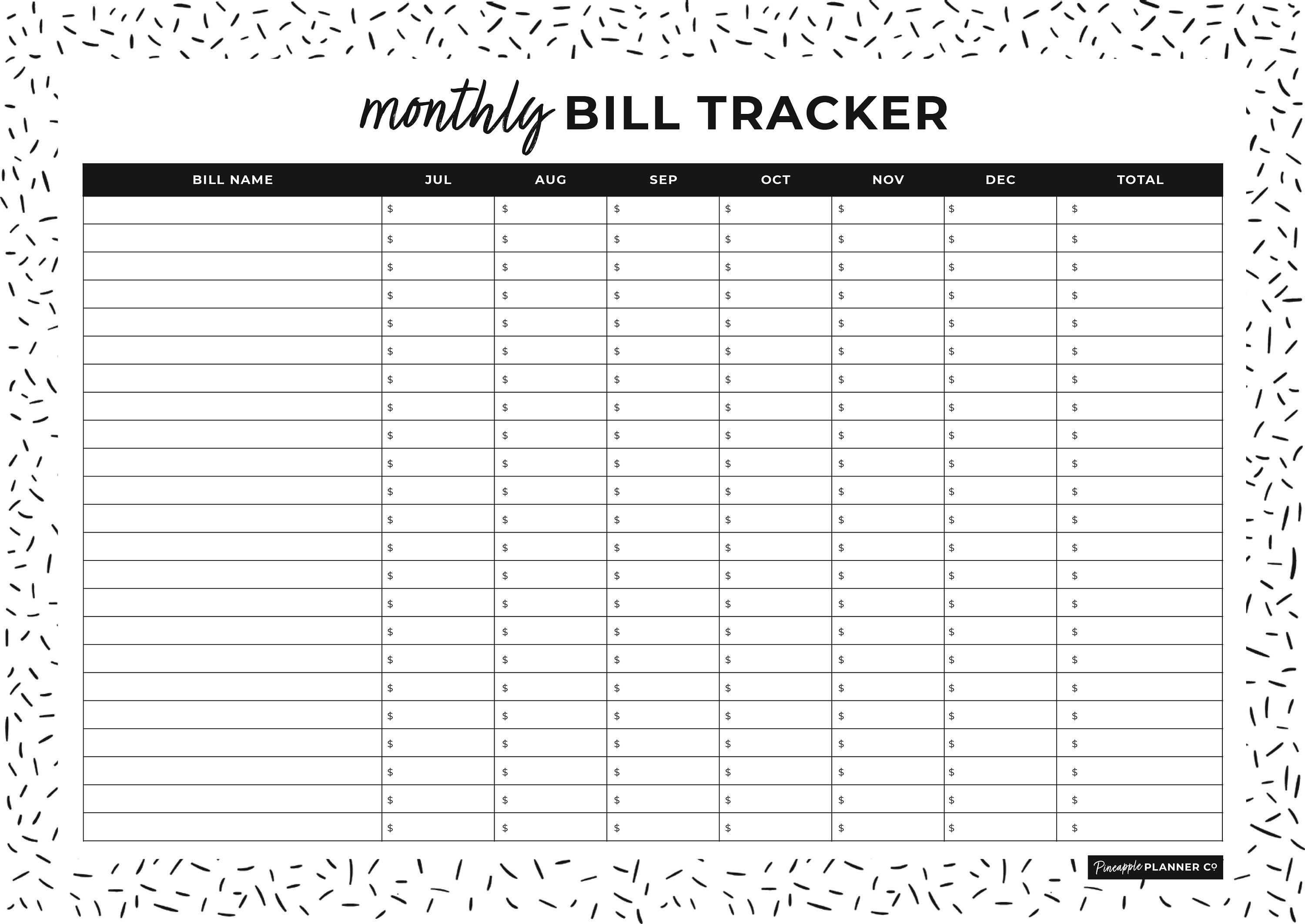

1. Monthly Bill Tracker

- This tracker provides an overview of all the bills that need to be paid within a month.

- It includes columns for bill names, due dates, amounts, and payment status.

- Individuals can easily track which bills have been paid and which ones are still pending.

2. Weekly Bill Tracker

- For individuals who prefer a more detailed approach, a weekly bill tracker can be used.

- It breaks down the bills and payments on a weekly basis, providing a more focused view of the financial obligations.

- This tracker can be particularly useful for those who receive weekly paychecks or have bills that need to be paid on a weekly basis.

3. Specific Bill Tracker, Free printable bill tracker

- In addition to general bill trackers, there are also specific trackers available for certain types of bills.

- For example, there are trackers specifically designed for tracking utility bills, credit card payments, or rent payments.

- These trackers often include additional columns or sections that are specific to the type of bill being tracked.

Using a printable bill tracker can greatly contribute to better financial management. It helps individuals stay organized, avoid late payments, and have a clear understanding of their financial obligations. By utilizing the different types of bill trackers available, individuals can choose the one that best suits their needs and effectively manage their personal finances.

How to Find Free Printable Bill Trackers

Finding free printable bill trackers online can be a convenient and cost-effective way to manage your finances. Here are some tips on where to find them and how to choose the right one for your needs.

Search on Websites or Platforms

There are several websites and platforms that offer free bill tracker templates. Here are some popular options:

- 1. Template.net: This website offers a wide range of templates, including bill trackers. Simply search for “bill tracker” in the search bar to find various options to choose from.

- 2. Vertex42.com: This website provides free printable bill tracker templates in Excel and PDF formats. You can easily download and customize them according to your requirements.

- 3. Pinterest: Pinterest is a great platform to find free printable bill trackers. Simply search for “free bill tracker printables” or similar s, and you will find a wide variety of designs and styles to choose from.

Choosing the Right Printable Bill Tracker

When selecting a printable bill tracker, consider the following factors:

- 1. Format: Determine whether you prefer a digital or physical format. Digital trackers can be downloaded and used on your computer or mobile device, while physical trackers can be printed and filled out manually.

- 2. Design: Look for a design that is visually appealing and easy to navigate. A well-organized layout will make it easier for you to track your bills and payments.

- 3. Features: Consider the features you need in a bill tracker. Some templates may include additional sections for budgeting, expense tracking, or financial goals. Choose one that aligns with your specific requirements.

- 4. Customizability: Check if the template allows you to customize it according to your preferences. This can include adding or removing sections, changing colors or fonts, and adjusting the layout to suit your needs.

Remember to always download printable bill trackers from reliable sources to ensure the templates are accurate and free from any viruses or malware.

Features and Design of a Printable Bill Tracker

A bill tracker is a useful tool for managing and organizing your bills. It helps you keep track of important details such as bill amounts, due dates, and payment status. Here are some essential features that a bill tracker should have:

Space for Recording Bill Details

A good bill tracker should provide ample space for recording all the necessary details of your bills. This includes the name of the bill, the amount due, and any additional notes or comments. Having designated spaces for each bill helps you easily identify and locate the information you need.

Due Dates

Another important feature of a bill tracker is the ability to record due dates. This allows you to stay on top of your payment schedule and avoid late fees or penalties. The bill tracker should have a clear and organized layout that allows you to easily see when each bill is due.

Payment Status

Keeping track of the payment status of your bills is crucial for maintaining your financial health. A bill tracker should include a section where you can mark whether a bill has been paid, is pending, or is overdue. This helps you stay organized and prioritize your payments accordingly.Now

let’s discuss different design options for printable bill trackers:

Simple Tables

A simple table layout is a popular choice for bill trackers. It provides a clean and straightforward design, making it easy to read and fill out. The table can have columns for bill details, due dates, payment status, and any additional information you want to include.

Colorful Layouts

If you prefer a more visually appealing bill tracker, you can opt for a colorful layout. This design option allows you to use different colors to categorize bills or highlight important information. For example, you can use different colors to represent different types of bills or to indicate the urgency of payment.

Themed Templates

Themed templates add a touch of personality to your bill tracker. You can choose a template that matches your style or interests, such as a floral design, a travel theme, or a minimalist aesthetic. Themed templates can make tracking your bills more enjoyable and engaging.Here

are some examples of printable bill trackers with various designs and layouts:

- A simple table layout with columns for bill details, due dates, and payment status.

- A colorful layout with different colors to represent different types of bills.

- A themed template with a travel theme, featuring images of different destinations.

- A minimalist design with clean lines and a focus on simplicity.

Remember, the design of your bill tracker should be based on your personal preferences and needs. Choose a design that makes it easy for you to track and manage your bills effectively.

How to Use a Free Printable Bill Tracker

Using a free printable bill tracker can greatly help you stay organized and on top of your finances. Here are some step-by-step instructions on how to effectively use a printable bill tracker:

1. Print or Download the Bill Tracker

Start by finding a free printable bill tracker template that suits your needs. You can easily find these templates online by searching for “free printable bill tracker.” Once you have found a template you like, either print it out or download it to your computer.

2. Fill in the Necessary Information

Once you have the bill tracker in front of you, start filling in the necessary information. This usually includes the name of the bill, the due date, the amount due, and any additional notes or reminders. Make sure to fill in all the relevant details for each bill you want to track.

3. Set Up a System for Organization

To keep your bill tracker organized, you can use different methods. One common approach is to sort your bills by due date, either in chronological order or by grouping them into monthly categories. You can also color-code your bills or use different sections for different types of bills (e.g.,

utilities, credit cards, subscriptions).

4. Update the Tracker Regularly

To ensure the accuracy of your bill tracker, make it a habit to update it regularly. Whenever you receive a bill, immediately record the relevant information in your tracker. This includes the due date, the amount due, and any payments made.

If you’re considering trying Eliquis and want to save money, you can take advantage of this eliquis 30-day free trial printable coupon . This coupon allows you to receive a 30-day supply of Eliquis at no cost. Simply print out the coupon and present it to your pharmacist when filling your prescription.

It’s a great way to try out the medication and see if it works for you without having to spend any money upfront. Don’t miss out on this opportunity to save on your Eliquis prescription.

Regularly updating your bill tracker will help you stay on top of your bills and avoid missing any payments.

5. Use Reminders and Notifications

To stay consistent and disciplined with using your bill tracker, take advantage of reminders and notifications. Set up reminders on your phone or computer to alert you of upcoming due dates. You can also enable notifications from your bill tracking app or software if you prefer using digital tools.

6. Review and Analyze Your Tracker

Periodically review and analyze your bill tracker to gain insights into your spending habits and financial health. Look for patterns or trends in your bill payments and identify areas where you can potentially save money. Use your bill tracker as a tool for financial management and make adjustments to your budget or spending habits as needed.Using

a free printable bill tracker can be a powerful tool for better financial management. By following these steps and staying consistent with using your tracker, you can stay organized, avoid late payments, and gain control over your finances.

Benefits of Using a Free Printable Bill Tracker

Using a printable bill tracker for personal financial management offers several advantages. Let’s explore how this tool can benefit you in managing your finances effectively.

Improved Financial Organization

A bill tracker helps you stay organized by providing a centralized location to track all your bills and payments. It allows you to have a clear overview of your financial obligations, due dates, and payment history. With this information readily available, you can easily manage your finances and avoid missing any payments.

Better Budgeting

A printable bill tracker is an essential tool for budgeting. By recording your bills and expenses, you can gain a comprehensive understanding of your spending habits. This insight enables you to identify areas where you can cut back and make necessary adjustments to meet your financial goals.

With a bill tracker, you can create a realistic budget and track your progress towards achieving it.

Expense Tracking

Tracking your expenses is crucial for maintaining financial stability. A bill tracker allows you to monitor your spending habits and identify any unnecessary or excessive expenses. By categorizing your expenses, you can analyze where your money is going and make informed decisions to reduce unnecessary spending.

This helps you develop better financial habits and ensures you are in control of your expenses.

Avoid Late Payments

Late payments can have detrimental effects on your credit score and financial well-being. A bill tracker acts as a reminder system, notifying you of upcoming due dates. By staying on top of your bill payments, you can avoid late fees, penalties, and negative impacts on your credit history.

A printable bill tracker helps you stay organized and ensures timely payments, keeping your finances in good standing.

Testimonials and Success Stories

Many individuals have experienced the benefits of using a bill tracker. Testimonials from satisfied users highlight how the tool has helped them gain control over their finances, reduce stress, and achieve their financial goals. Some have successfully paid off debts, saved for major purchases, or improved their credit score by utilizing a bill tracker.

These success stories serve as inspiration and motivation for others to start using this valuable financial management tool.Incorporating a free printable bill tracker into your financial routine can significantly improve your financial management skills. It helps you stay organized, budget effectively, track your expenses, and avoid late payments.

If you’re looking for a farkle scoring sheet that you can print out, check out this farkle scoring sheet printable . It’s a convenient way to keep track of your scores while playing the game. Simply download and print the sheet, and you’ll have everything you need to start playing.

The sheet includes spaces for each player’s name and score, as well as a section for recording the round number. With this printable scoring sheet, you’ll never have to worry about forgetting or losing track of your scores again.

Take advantage of this powerful tool and experience the positive impact it can have on your financial well-being.

Tips for Customizing a Printable Bill Tracker

Customizing a printable bill tracker allows individuals to tailor the tracker to their specific preferences and needs. By adding additional sections or columns, you can create a bill tracker that is personalized and suits your financial management style. Here are some tips for customizing a printable bill tracker:

1. Categorize your expenses

One way to customize your bill tracker is by categorizing your expenses. You can add sections or columns for different categories such as rent/mortgage, utilities, groceries, transportation, and entertainment. This allows you to track your spending in specific areas and get a clear picture of where your money is going.

2. Include due dates and payment methods

To stay organized and ensure timely payments, consider adding columns for due dates and payment methods. This will help you keep track of when bills are due and how you plan to pay them (e.g., credit card, online transfer, cash).

Having this information readily available in your bill tracker can prevent missed payments and late fees.

3. Track payment status

If you want to monitor the status of your bill payments, you can customize your tracker by adding a column for payment status. This allows you to mark whether a bill has been paid, is pending, or is overdue. Tracking payment status can help you stay on top of your bills and avoid any financial surprises.

4. Budget and savings goals

If you’re looking to manage your finances more effectively, consider adding sections or columns for budgeting and savings goals. You can allocate a certain amount of money for each expense category and track your progress towards your savings goals. Customizing your bill tracker in this way can help you stay focused on your financial objectives.

5. Add notes or reminders

To make your bill tracker more comprehensive, you can include sections for notes or reminders. This allows you to jot down any important information related to your bills, such as customer service numbers, special offers, or upcoming changes in billing cycles.

Adding notes or reminders can help you stay organized and ensure you have all the necessary information at your fingertips.

6. Use color coding or highlighting

To make your bill tracker visually appealing and easy to navigate, consider using color coding or highlighting. You can assign different colors to different expense categories or use highlighting to draw attention to important due dates or payment amounts. Customizing your bill tracker in this way can make it more engaging and user-friendly.

These are just a few suggestions for customizing a printable bill tracker. Remember, the goal is to create a tracker that works for you and helps you stay on top of your bills. Feel free to experiment with different layouts, sections, and designs until you find the perfect customization for your needs.

Printable Bill Tracker vs. Digital Bill Tracker

Using a bill tracker is an effective way to keep track of your bills and manage your finances. However, when it comes to choosing between a printable bill tracker and a digital bill tracker, there are several factors to consider.

In this section, we will compare and contrast the advantages and disadvantages of using each option, discuss situations where a printable bill tracker may be more beneficial or vice versa, and provide insights on how to choose between the two.

Advantages and Disadvantages of Printable Bill Tracker

A printable bill tracker is a physical document that you can print and fill out manually. Here are some advantages of using a printable bill tracker:

- Accessibility: A printable bill tracker can be easily accessed without the need for an internet connection or any specific device.

- Customization: You have the freedom to customize the design and layout of your printable bill tracker according to your preferences.

- Tactile Experience: Some people find the act of physically writing down their bills and expenses to be more satisfying and effective in tracking their finances.

On the other hand, there are also some disadvantages to using a printable bill tracker:

- Manual Input: Filling out a printable bill tracker requires you to manually input all the necessary information, which can be time-consuming and prone to errors.

- Limited Storage: As a physical document, a printable bill tracker may take up space and can be easily misplaced or lost.

- No Automatic Calculations: Unlike digital bill trackers, printable bill trackers do not have built-in formulas or calculations, so you need to do the math yourself.

Advantages and Disadvantages of Digital Bill Tracker

A digital bill tracker, on the other hand, is a software or app that allows you to track your bills electronically. Here are some advantages of using a digital bill tracker:

- Convenience: With a digital bill tracker, you can access your bills and financial information anytime, anywhere, as long as you have an internet connection and a compatible device.

- Automatic Calculations: Digital bill trackers often have built-in formulas and calculations, saving you time and reducing the risk of errors.

- Data Analysis: Many digital bill trackers provide data analysis and visualizations, allowing you to gain insights into your spending habits and financial patterns.

However, there are also some disadvantages to using a digital bill tracker:

- Dependence on Technology: Digital bill trackers rely on technology, which means they may be subject to technical issues, software updates, or compatibility problems.

- Security Risks: Storing your financial information digitally may pose security risks, such as hacking or data breaches, although many digital bill trackers have robust security measures in place.

- Learning Curve: Using a new software or app may require some time to learn and get accustomed to, especially for those who are not tech-savvy.

Choosing Between Printable and Digital Bill Tracker

When deciding between a printable bill tracker and a digital bill tracker, consider the following factors:

- Your Preferences: Think about whether you prefer the tactile experience of writing on a physical document or the convenience of accessing your bills digitally.

- Your Lifestyle: Consider your lifestyle and habits. If you are constantly on-the-go and rely heavily on technology, a digital bill tracker may be more suitable for you. However, if you prefer a low-tech approach or have limited access to technology, a printable bill tracker may be a better choice.

- Your Tracking Needs: Evaluate the complexity of your bill tracking needs. If you have a simple budget and only need to track a few bills, a printable bill tracker may suffice. However, if you have multiple bills and require more advanced features like automatic calculations or data analysis, a digital bill tracker may be more beneficial.

Ultimately, the choice between a printable bill tracker and a digital bill tracker depends on your personal preferences, lifestyle, and tracking needs. Consider the advantages and disadvantages of each option and choose the one that aligns best with your financial management goals.